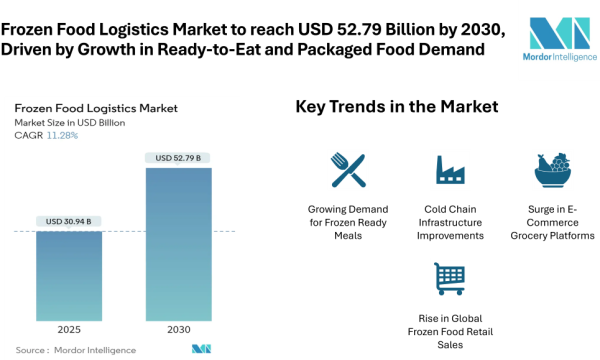

Frozen Food Logistics Market to reach USD 52.79 Billion by 2030, Driven by Growth in Ready-to-Eat and Packaged Food Demand

Posted June 23, 2025 by mordorintelligence

Mordor Intelligence has published a new report on the Frozen Food Logistics Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

The Frozen Food Logistics Market size is estimated at USD 30.94 billion in 2025, and is expected to reach USD 52.79 billion by 2030, at a CAGR of 11.28%. This growth is being driven by the increased consumption of frozen meals, innovations in cold chain systems, and the expansion of organized retail and e-commerce delivery channels.

The Frozen Food Logistics Market encompasses the transportation, storage, and distribution of temperature-sensitive food products, ensuring they remain safe and consumable throughout the supply chain. With rising urbanization, demand for convenient food options, and consumer preferences shifting toward ready-to-cook and ready-to-eat meals, the market is gaining traction across both developed and emerging economies.

Key Trends

1. Growing Demand for Frozen Ready Meals

Changing lifestyles and busier work routines have significantly altered global food consumption patterns. Consumers are increasingly turning to frozen ready meals as a convenient solution for saving time without compromising on taste or nutritional value. This shift is especially strong in urban areas, where young professionals and families with dual incomes rely on ready-to-eat or easy-to-prepare food products. This rising demand is creating consistent pressure on logistics providers to ensure timely, temperature-controlled delivery while maintaining food quality and safety throughout the supply chain.

2. Cold Chain Infrastructure Improvements

The logistics of frozen food rely heavily on robust cold chain infrastructure, which includes temperature-controlled warehouses, refrigerated trucks, and monitoring systems. Over the last few years, there has been notable investment in expanding and upgrading this infrastructure, particularly in developing countries. Companies are deploying advanced technologies like Individual Quick Freezing (IQF), real-time temperature tracking, and automated warehousing systems to reduce spoilage and increase efficiency. As infrastructure becomes more sophisticated, it helps logistics providers manage a wider range of frozen products across longer distances without compromising shelf life or safety.

3. Surge in E-Commerce Grocery Platforms

The rapid rise of online grocery platforms is one of the most transformative trends in the frozen food logistics sector. Consumers now expect doorstep delivery of frozen foods with the same quality and freshness as retail store purchases. To meet these expectations, logistics firms must integrate cold chain capabilities into last-mile delivery systems, which has historically been a weak link in the frozen supply chain. Companies are adapting with smaller, strategically located cold storage hubs and insulated packaging solutions. This is especially critical in densely populated urban areas where speed, reliability, and temperature control are non-negotiable.

4. Rise in Global Frozen Food Retail Sales

According to recent market trends, frozen food sales in retail are not only growing in volume but also in consumer spend per unit. In the United States alone, frozen food retail sales increased by nearly USD 10 billion over three years, reaching USD 74.2 billion in 2023. This surge reflects broader global behavior, where consumers are embracing frozen products for their long shelf life and consistent quality. The increased turnover of frozen foods in retail chains directly impacts logistics demand, requiring faster warehouse processing, frequent replenishment cycles, and optimized transport planning.

5. Environmental and Regulatory Focus

As the frozen food logistics sector grows, so does its environmental footprint—particularly in terms of energy use in cold storage and refrigerated transport. To address this, logistics providers are increasingly investing in energy-efficient equipment, adopting low-emission refrigerants, and optimizing delivery routes to reduce fuel usage. In parallel, governments and regulatory bodies are enforcing stricter guidelines for food safety, packaging, and emissions. Compliance with these evolving regulations is becoming a key part of operations and cost planning, encouraging logistics companies to prioritize sustainability without sacrificing performance.

Market Segmentation

The Frozen Food Logistics Market is segmented by product type, product category, mode of transport, and geography:

By Product Type:

Frozen Fruits and Vegetables

Frozen Meat and Fish

Frozen Cooked Ready Meals

Frozen Desserts

Frozen Snacks

Other Products

Frozen cooked ready meals and frozen snacks are experiencing increased demand due to convenience and wider availability in supermarkets and online platforms.

By Product Category:

Ready-to-Eat

Ready-to-Cook

Ready-to-eat products are a fast-growing segment, particularly popular among working professionals and younger consumers seeking minimal preparation time.

By Mode of Transport:

Roadways

Railways

Seaways

Airways

Roadways currently account for the largest share due to cost-effectiveness and flexibility, while airways are used for urgent deliveries and high-value shipments.

By Geography:

North America

Europe

Asia-Pacific

South America

Middle East & Africa

North America and Europe lead the market with well-developed cold chain infrastructure. However, Asia-Pacific is expected to witness the fastest growth, driven by urbanization, increasing disposable incomes, and changing dietary habits.

Explore Our Full Library of Logistics Research Industry Reports: https://www.mordorintelligence.com/market-analysis/logistics?utm_source=prfree.org

Key Players

The Frozen Food Logistics Market features a mix of global and regional companies with capabilities across the cold chain ecosystem. Some of the major players include:

Lineage Logistics – A major provider of temperature-controlled logistics and warehousing, with a global footprint and automation-driven cold storage solutions.

Americold Logistics – Operates an extensive network of temperature-controlled warehouses across North America and is expanding in international markets.

Swire Cold Storage – A key player in Australia, offering refrigerated storage and distribution solutions tailored to food manufacturers and retailers.

Nichirei Logistics – A leading logistics provider in Japan, known for its advanced cold storage systems and integrated distribution solutions.

VersaCold Logistics Services – One of Canada’s largest supply chain companies focused exclusively on the handling of temperature-sensitive food products.

These companies are continuously investing in capacity expansion, energy-efficient warehousing, and automation to meet the growing and complex demands of the frozen food sector.

For complete market analysis, visit the Mordor Intelligence Page: https://www.mordorintelligence.com/industry-reports/frozen-food-logistics-market?utm_source=prfree.org

Conclusion

The frozen food logistics market is experiencing strong momentum due to evolving consumer preferences, increasing demand for convenience, and a broader shift toward organized retail and e-commerce platforms. As lifestyles continue to accelerate and food choices become more diverse, the need for efficient cold chain systems has become critical for ensuring product safety, quality, and availability. Logistics providers are adapting by investing in advanced infrastructure, adopting smart tracking systems, and expanding their regional networks to meet rising expectations. At the same time, growing regulatory requirements and environmental concerns are shaping how companies operate, driving innovation in energy-efficient solutions and sustainable practices. With continued focus on reliability, speed, and quality, the frozen food logistics sector is poised for sustained expansion across global markets.

Industry Related Reports

Cold Chain Logistics Market: Cold Chain Logistics Market is segmented by by Service (Refrigerated Storage, Refrigerated Transportation and Value-Added Services), by Temperature Type (Chilled (0–5 °C), Frozen (-18–0 °C) and More), by Application (Fruits & Vegetables, Meat & Poultry, Fish & Seafood and More), and by Geography (North America, South America, Asia Pacific, and More).

Get more insights: https://www.mordorintelligence.com/industry-reports/cold-chain-logistics-market?utm_source=prfree.org

North America Food Cold Chain Logistics Market: North America Food Cold Chain Logistics Market is segmented by Application (Fruits and Vegetables, Meat and Seafood, Dairy and Frozen Dessert, Bakery and Confectionery, Ready-to-Eat Meal, Other Applications), By Service Type (Refrigerated Storage, Refrigerated Transport, Airways, Roadways, Seaways, Railways), and Geography (US, Canada, Mexico).

Get more insights: https://www.mordorintelligence.com/industry-reports/north-america-food-cold-chain-logistics-market?utm_source=prfree.org

Australia Cold Chain Logistics Market: The Australia Cold Chain Logistics Market report segments the industry into By Services (Storage, Transportation, Value-Added Services (Blast Freezing, Labeling, Inventory Management, etc.)), By Temperature Type (Chilled, Frozen), and By Application (Fruits & Vegetables, Dairy Products, Meat and Seafood, Processed Food, Pharmaceuticals (Include Biopharma), Bakery and Confectionery, Other Applications).

Get more insights: https://www.mordorintelligence.com/industry-reports/australia-cold-chain-logistics-market?utm_source=prfree.org

Canada Cold Chain Logistics Market: Canada Cold Chain Logistics Market is Segmented by Service (Storage, Transportation, and Value-Added Services), by Temperature Type (Chilled, Frozen and Ambient), and by End User (Horticulture, Dairy Products, Meats, Fish, Poultry, Processed Food Products, Pharma, Life Sciences, and Chemicals, and Other Applications).

Get more insights: https://www.mordorintelligence.com/industry-reports/canada-cold-chain-logistics-market?utm_source=prfree.org

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

[email protected]

https://www.mordorintelligence.com/

| Contact Email | [email protected] |

| Issued By | Mordor Intelligence |

| Website | Mordor Intelligence |

| Phone | 16177652493 |

| Business Address | Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana – 500032, India. |

| Country | India |

| Categories | Food |

| Tags | frozen food logistics market , frozen food logistics market size , frozen food logistics market share , frozen food logistics market analysis , frozen food logistics market report , frozen food logistics market trends , frozen food logistics industry |

| Last Updated | June 23, 2025 |